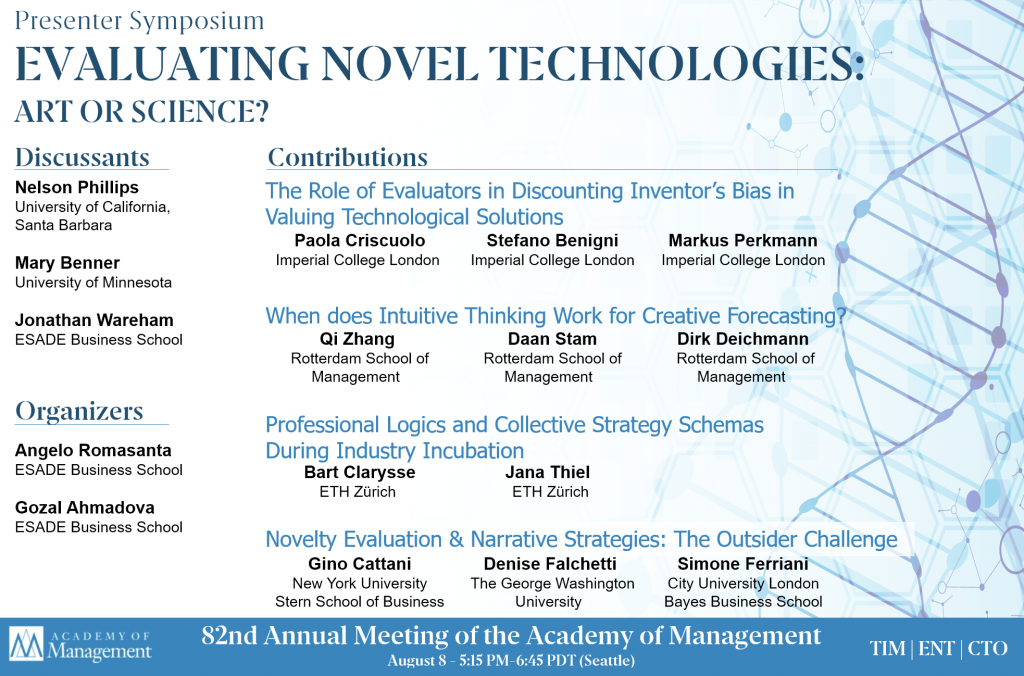

The Academy of Management Annual Meeting is happening next week. We are organizing a presenter symposium on evaluating novel technologies with some of the most known scholars in this area.

In the meantime, let me share some interesting papers in this area that I’ve read.

Specialists, Generalists, or Both? Founders’ Multidimensional Breadth of Experience and Entrepreneurial Ventures’ Fundraising at IPO – a mixed quantitative and experimental study. The researchers find that “while generalist founders might be beneficial for starting up a venture, it appears that public investors have less trust in such multifaceted founders at the later stage of IPO. Indeed, for these later-stage entrepreneurial ventures, investors trust “consistent” specialists to scale the business.“

Will the startup succeed in your eyes? Venture evaluation of resource providers during entrepreneurs’ informational signaling – a study comparing evaluation outcomes between investors with/without founding experience. The interesting part is also considering gaining support from founders without investing experience. The study suggests that ventures may be better off engaging with experienced founders as it may increase the likelihood of receiving positive venture evaluation, which can then lead to higher chances of receiving resource support. While the study finds no difference between founders and investors in their willingness to invest financial resources, those with founding experience tend to be more open to providing social support to new ventures.

Evaluating Ventures Fast and Slow: Sensemaking, Intuition, and Deliberation in Entrepreneurial Resource Provision Decisions – inspired by the famous book by Daniel Kahneman, the article provides a framework on how investors make decisions through a combination of sensemaking, intuition and deliberation.

A Game Theoretic Approach to the Selection, Mentorship, and Investment Decisions of Start-Up Accelerators – proposes a model using game theory on the value provided by accelerators. This study was a bit difficult for me to follow given my lack of background in these math-heavy formal models. Nonetheless, what was interesting was their implication that the most important role of an accelerator is its screening, that is, before mentorship, and seed investment.

The effects of exposure to others’ ideas and their ratings on online crowdsourcing platforms on the quantity and novelty of subsequently generated ideas – analyzes ideas posted in two crowdsourcing platforms by Starbucks and Lego, combined with two experiments. They find that exposure to different kinds of ideas leads to different subsequent ideas depending on the novelty and quality of the original idea.